Injective (INJ) has earned its reputation as a versatile and innovative blockchain platform tailored for decentralized finance (DeFi). Often described as the “Swiss army knife” of DeFi, Injective’s rapid growth and the introduction of advanced financial tools, such as the BUIDL Index—the world’s first perpetual market tracking the supply of BlackRock’s BUIDL Fund—highlight its pioneering role in tokenized assets and real-world financial products. With this, Injective has opened the door for around-the-clock exposure to assets like U.S. treasuries, all with the option for leveraged trading.

Why Injective is Special

Injective’s blockchain architecture is built on Cosmos SDK, enabling seamless interoperability with other Cosmos-based chains. However, what sets Injective apart is its integration with non-Cosmos ecosystems like Ethereum, Solana, and Avalanche. Injective’s inEVM (Injective Ethereum Virtual Machine) and inSVM (Injective Solana Virtual Machine) allow developers to deploy Solidity and Rust smart contracts, making it a bridge across diverse blockchains.

Here’s what makes Injective a top pick:

Key Features:

- Fiat On-ramp via Mercuryo: Injective provides a straightforward way to buy its native token ($INJ) using fiat currencies. Its partnership with Mercuryo supports over 25 fiat currencies through payment methods like Visa, Mastercard, and bank transfers.

- Tokenized Financial Products: Injective enables the trading of tokenized financial products, including BlackRock’s BUIDL Fund, which used to be accessible only to institutions with a $5 million minimum investment. Now, individuals can invest with as little as $1.

- Advanced Web3 Modules: Injective offers ready-made DeFi modules such as limit order books and insurance modules, allowing developers to deploy financial services with minimal overhead. This plug-and-play approach speeds up development and innovation.

- Low Transaction Fees: Injective’s gas compression technology reduces fees significantly, enabling users to execute more than 3,000 transactions for just $1.

- Constant Innovation and Integration: Injective has integrated with the TON ecosystem and recently upgraded its Layer 1 blockchain with the Altaris Mainnet, improving scalability and asset tokenization capabilities. It also introduced the first Real-World Asset (RWA) Oracle and yield-bearing stablecoins through Mountain Protocol.

The Bullish Case for Injective

Injective has simplified DeFi development with its pre-built modules, such as insurance for higher leverage, an exchange module for trading, and the Peggy module for bridging ERC-20 tokens between Ethereum and Cosmos. This significantly reduces the development burden for teams, making Injective the go-to platform for building DeFi protocols.

In short, Injective’s infrastructure allows developers to build financial applications much faster than on other platforms. With its continuous upgrades, tokenization of real-world assets, and powerful integration with other chains, Injective is well-positioned to thrive as DeFi continues to grow.

A growing ecosystem of DeFi projects

The Injective ecosystem has taken off since the launch of mainnet in mid-2022. Helix, DojoSwap, and Hydro, are the biggest projects, accounting for about 80% of the TVL.

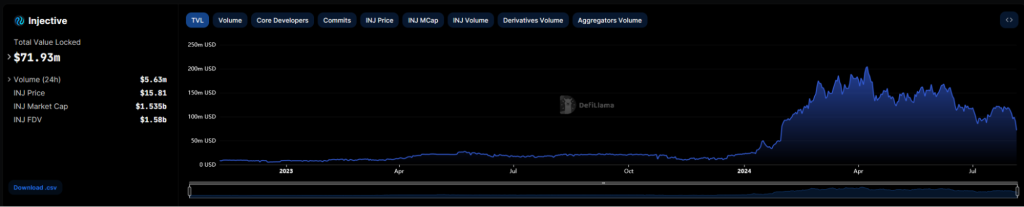

Injective’s TVL has skyrocketed from ~$30M to $142M this year, marking a 450% increase in just two months. This surge highlights growing demand despite market volatility.

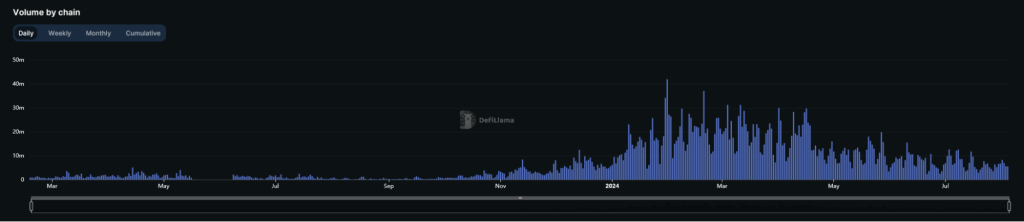

Injective excels in DeFi with features like Helix, its built-in DEX with order books, similar to Serum on Solana. Helix shares liquidity across all Injective DEXs, ensuring deep pools for high-frequency trading. This setup supports thriving protocols like NinjaRoll, a prediction market.

Helix volumes have surged since December 2023, reflecting increased on-chain activity and a healthy growth trend for Injective. Higher DEX volumes signal a thriving ecosystem, with new users staying engaged.

HydroFi, a newer protocol on Injective, has been a major driver of TVL growth, contributing around 50% of Injective’s total. Launched in February, HydroFi has quickly amassed over $122 million in TVL, with half of that on Injective.

Injective is also embracing innovation with the CW-404 standard, which builds on the ERC-404 concept for making non-fungible tokens fungible while retaining their unique properties.

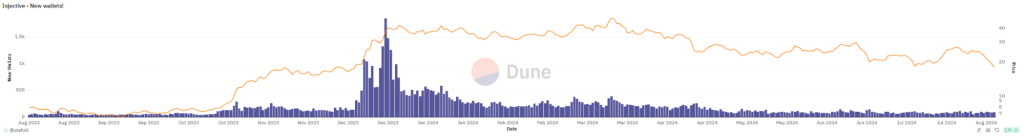

Injective is rapidly attracting new users, as shown by a significant surge in unique wallet counts in late 2023. The platform’s robust growth is supported by its solid blockchain foundation and key growth catalysts.

Tokenomics Overview

The INJ token is used for transaction fees, network security via Proof-of-Stake, and governance. Here are the key metrics:

- Circulating Supply: 97.73 million INJ

- Total Supply: 100 million INJ

- Market Cap: $1.8 billion

- FDV (Fully Diluted Valuation): $1.842 billion

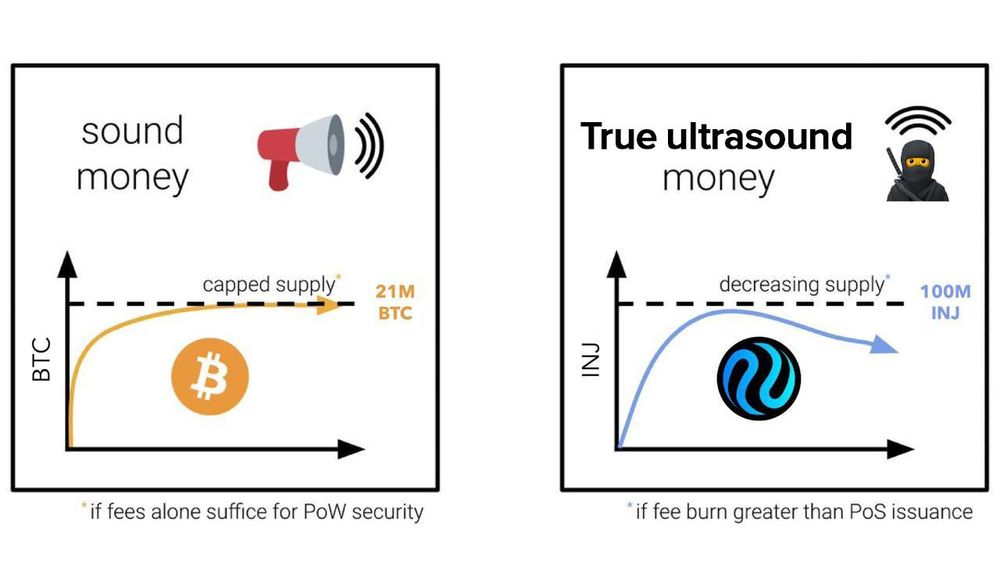

INJ benefits from a buy-and-burn mechanism where up to 100% of fees from protocols or dApps on Injective are burned weekly, making the token deflationary. This is effective as long as the burned fees exceed staking rewards.

Injective’s tokenomics are solid, with a strong foundation and increasing user engagement.

Competitive Edge

Injective stands out in the blockchain space primarily for its focus on DeFi. While Solana aims to dominate across various sectors, Injective is specialized for DeFi applications, positioning itself as a master of this niche.

Ethereum and its Layer-2 solutions are significant competitors, but Injective’s unique value lies in its specialization and recent integrations, such as with Arbitrum. This integration highlights Injective’s strategy to complement rather than compete with other blockchain ecosystems.

Injective continues to advance its goal of becoming the leading DeFi chain by emphasizing interoperability. The recent integration between inEVM and Arbitrum marks another significant achievement for Injective. The inEVM allows INJ to be used as a gas token, similar to ETH on Ethereum. As Injective integrates with more chains, it will likely see increased transactions and a larger validator set, which could lock up more INJ and potentially drive up its price.

Valuation and Price Targets

Injective’s current market cap stands at $1.8 billion, setting a high bar for short-term gains. While a 100x return is unlikely, there is still considerable growth potential, with aspirations to reach Solana-level valuations.

Key factors supporting Injective’s growth include:

- Developer Accessibility: Easy access to infrastructure for building.

- Standard Interoperability: Seamless connections with other chains.

- Deflationary Tokenomics: The buy-and-burn mechanism.

- User Growth: A spike in unique users and overall ecosystem buzz.

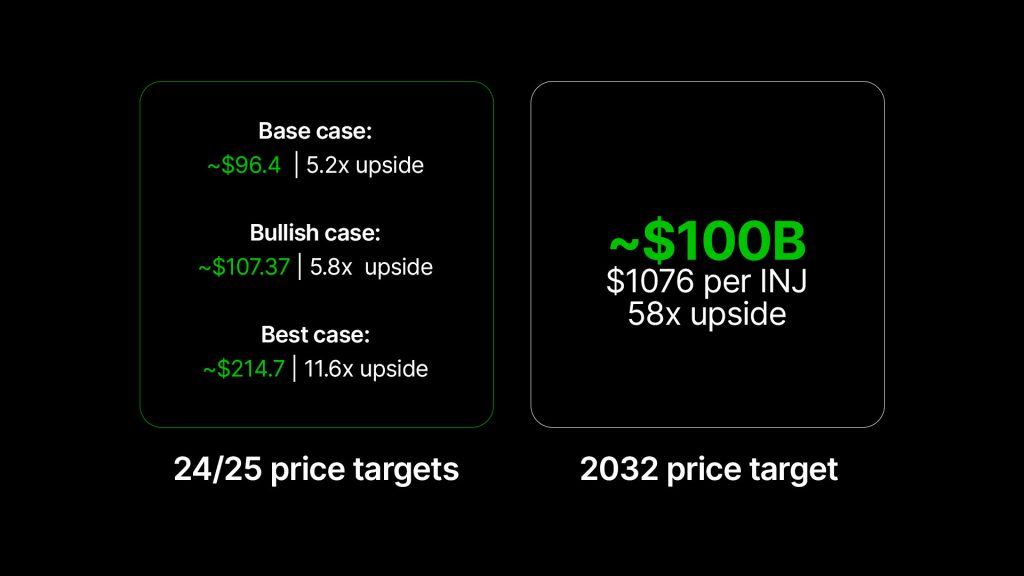

Future Market Cap Projections (24/25)

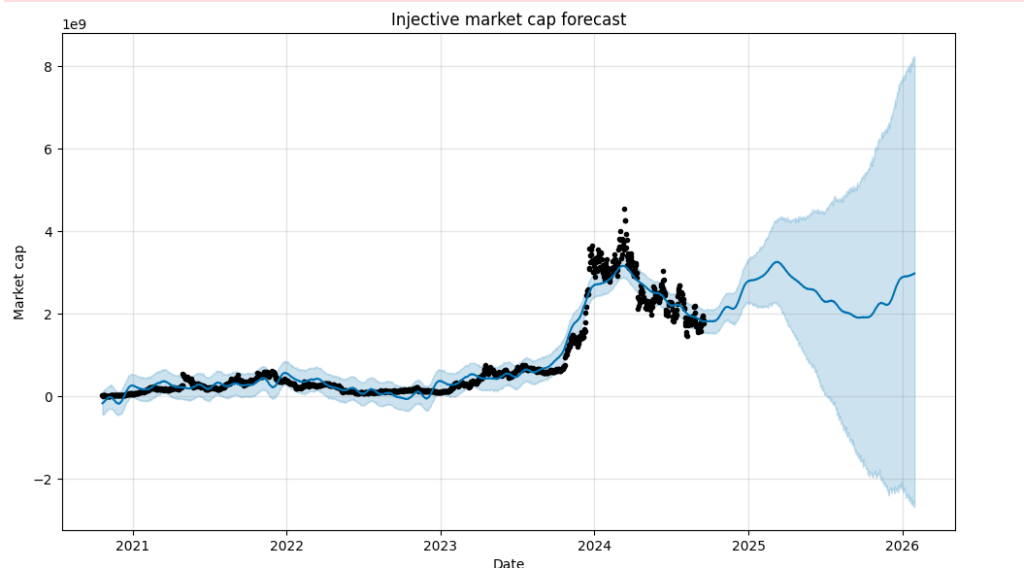

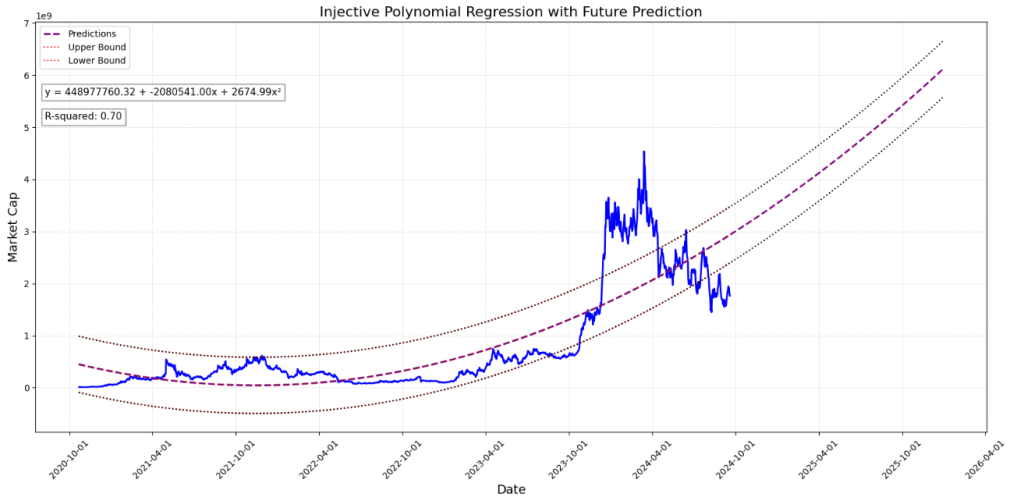

Using a blend of quantitative and qualitative methods, including machine-learning models, we forecast the following:

- Bearish Scenario: Based on Prophet forecasting, Injective’s market cap could reach approximately $2.97 billion by the end of 2025. With a projected INJ supply of 100 million tokens, this suggests a price of around $30.42 per INJ.

These projections reflect the significant potential for Injective, despite the current high market cap and existing competition.

Base scenario: This scenario suggests that the mcap of Injective is expected to reach $9.4b ($9,429,777,436) by the end of 2025. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Given the very high float of INJ, we will assume it is 100% circulating (100,000,000) and accept the ~2% error in our calculations. Considering future market cap and circulating supply, it will result in $96.4 per INJ per our base scenario.

- Bullish scenario: In this scenario, the model suggests that the mcap of Injective is expected to reach $10b ($9,968,634,159) by the end of 2025. The current supply of INJ is 97,727,222 tokens (97.7% circulating). Injective has amazing tokenomics, where the network burns fees generated by dapps, making INJ deflationary with growing adoption. For the bullish scenario, we will assume that 5% of the current supply will be burnt. Thus, we can expect a circulating supply of 92,840,860 tokens. Considering future market cap and circulating supply, it will result in $107.37 per INJ per our bullish scenario.

- Best scenario: In this scenario, the market can exceed our expectations, and things that we previously didn’t consider came up or were believed to be low-likelihood events. Potential changes might include a rebirth of the Cosmos ecosystem, failure of alternative L1s (e.g., Ethereum, Solana, etc.), and making Injective a de facto ecosystem for DeFi activities. To account for this scenario, we are doubling our bullish scenario to account for abnormal scenarios where things can get crazy.

Injective Valuation and Price Targets

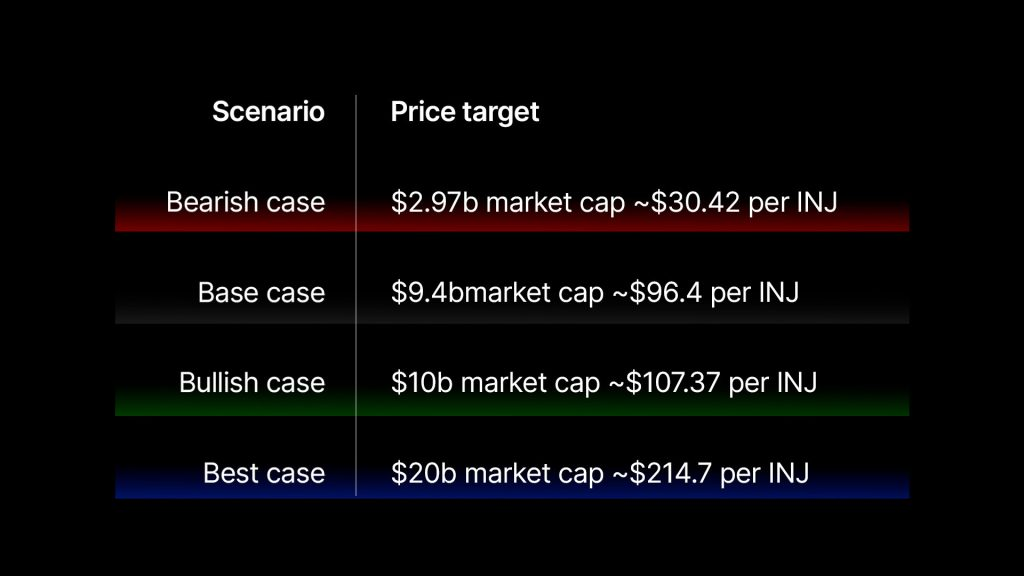

Short-Term Projections (2024/2025)

Given Injective’s current market cap of $1.8 billion, immediate 100x gains are unlikely. However, the project has significant growth potential, potentially reaching levels similar to Solana.

Valuation Scenarios:

- Bearish: Market cap could hit $2.97 billion, leading to an INJ price of $30.42.

- Base: Market cap might reach $9.43 billion, making INJ worth $96.40.

- Bullish: Market cap could reach $10 billion, with INJ valued at $107.37, assuming a 5% burn of current supply.

- Best: If conditions exceed expectations (e.g., dominance in DeFi), the market cap might double our bullish estimate, suggesting even higher values.

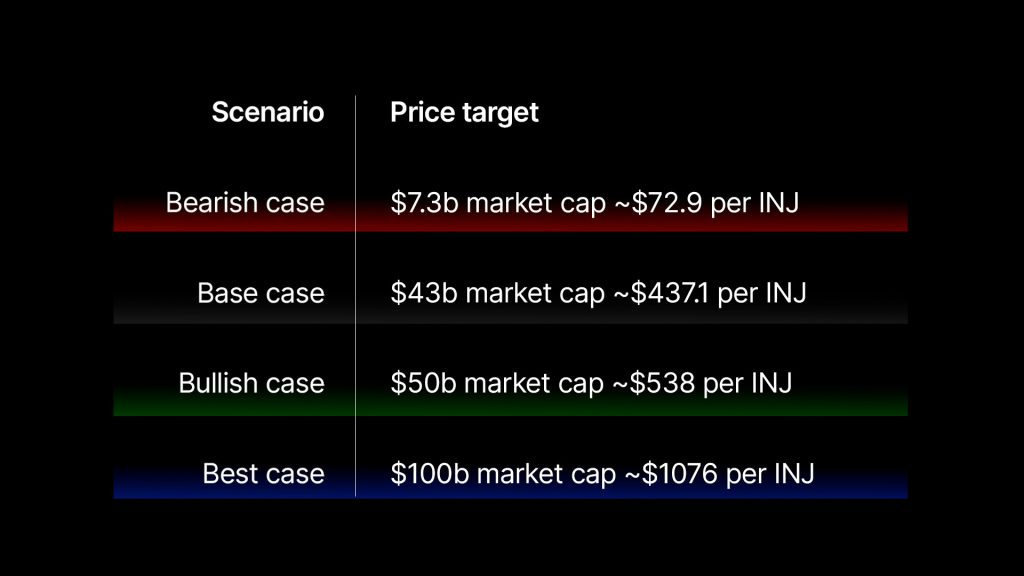

Long-Term Projections (2032)

For a longer view, we used various models to forecast:

- Bearish: Market cap could grow to $7.3 billion, leading to a price of $72.90 per INJ.

- Base: Market cap might reach $43.71 billion, making INJ worth $437.10.

- Bullish: With a market cap of $50 billion and a 5% burn, INJ could be valued at $538.

- Best: Under exceptional scenarios, such as significant ecosystem growth or DeFi market capture, the market cap could exceed our bullish estimate, leading to even higher valuations.

Summary

Injective’s solid fundamentals and growth trajectory suggest strong short-term and long-term potential. While immediate massive gains are improbable, the project’s innovative approach and growing ecosystem make it a promising candidate for future appreciation.

Crypto Mindz’s Take

Injective is a standout opportunity as we enter the bull market. Investing in its ecosystem or engaging in airdrop farming could significantly boost returns. Although some gains in INJ have already been realized, the potential for further growth remains strong.

Injective shines as an innovative Layer 1 blockchain with a dedicated focus on DeFi infrastructure and dApp development. Its specialization in decentralized derivatives and integration with Cosmos IBC give it a notable edge in interoperability and scalability. The project’s commitment to enhancing its ecosystem through partnerships and infrastructure upgrades is clear.

Key Points:

- Niche Focus: Injective’s emphasis on decentralized derivatives might limit its mainstream appeal, but its technical advancements and active developer community lay a solid foundation for future growth.

- Performance Comparison: Competing with Solana’s performance is challenging, but Injective’s DeFi-native modules position it as a potential “Solana Killer.”

- Future Outlook: Whether Injective can surpass Solana in market cap remains uncertain, but its impressive features and development trajectory make it a project to watch closely.

Injective’s innovative approach and ongoing developments make it a compelling choice for those interested in cutting-edge DeFi technology.