The Fed’s first 50bps rate cut is here, sparking a potential new wave of momentum in the crypto market. Could this ignite Bitcoin’s next rally?

In this report, we’ll cover:

- The Fed’s bold 50bps cut and why it wasn’t the expected 25bps

- How the new Dot Plot and unemployment forecasts point to a “soft landing”

- What this means for Bitcoin and risk assets

- Why Nasdaq’s breakout might signal a big crypto rally

- Our take on BTC and altcoin price action

Breaking Down the Fed’s Move

Yesterday, the Fed made its first rate cut of the cycle, lowering it from 5.50% to 5.00%. While many expected a 25bps cut, hints from Fed insiders suggested 50bps was in play. With the labor market weakening since June, the Fed now appears to be on a slow easing path.

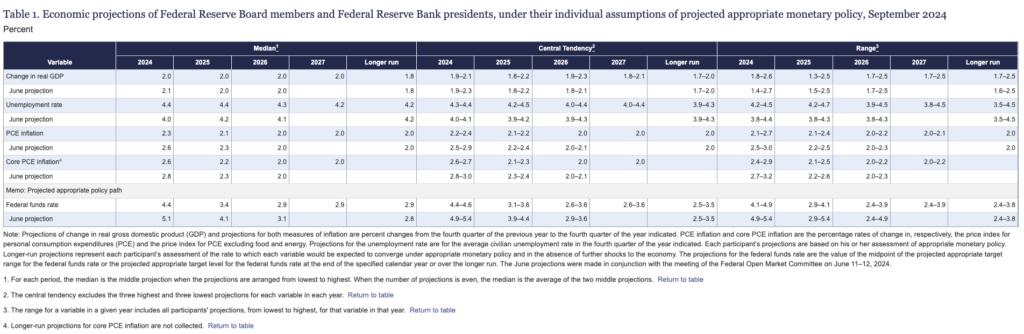

New Dot Plot & Unemployment

The updated Dot Plot indicates the Fed plans for a total of 150bps cuts by the end of 2025, with gradual 25bps cuts each quarter through 2024 and beyond. This aligns with a “soft landing” narrative, which could benefit risk assets like crypto. The labor market remains key, with the Fed forecasting an unemployment rate of 4.4% through 2025.

Key point: The soft landing is positive for crypto, as it signals a gradual reduction in interest rates.

What Does This Mean for Risk Assets?

Lower interest rates reduce capital costs and debt repayments, benefiting risk assets like Bitcoin, which often correlates with Nasdaq. Expect a potential multi-week BTC rally as risk appetite increases. Alts and meme coins could also see a short-term boost.

Nasdaq breakout potential: The index is nearing a breakout, and Bitcoin could follow.

CryptoMindz’s Take

BTC is testing resistance at $63,400, and we expect a brief pullback to $61,800 before a stronger rally over the weekend. Watch for altcoins to perform well in the next 3-5 days.