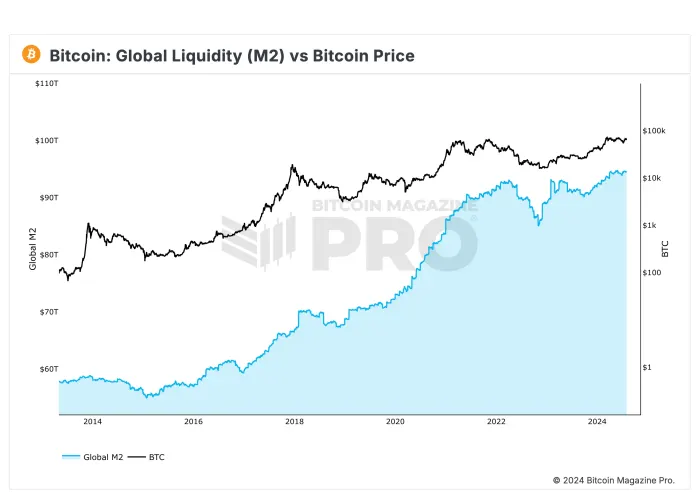

Global liquidity has reached a new record, exceeding $95 trillion and approaching the $100 trillion milestone. Historically, spikes in liquidity have preceded Bitcoin bull runs, making this development a key indicator for both investors and analysts. As global money supply rises, interest in riskier assets like Bitcoin typically follows, sparking potential price rallies.

Global liquidity refers to the total supply of money in circulation across major economies, including the U.S., China, the EU, and Japan. It encompasses the M2 money supply, which includes cash, bank deposits, money market funds, and near-money assets. Previous liquidity surges—$90 trillion in November 2021 and $95 trillion in March 2024—aligned with Bitcoin’s all-time highs of $69,000 and $73,000, respectively. This latest surge could potentially fuel another upward trend for Bitcoin, which has already recovered to around $64,500 after briefly dipping last month.

Bitcoin and Liquidity: A Strong Correlation

Expanding liquidity has historically driven spending on riskier investments like cryptocurrencies. When central banks increase money supply and lower interest rates, it often boosts demand for assets like Bitcoin, which is viewed by many as a hedge against inflation and traditional financial systems. With global liquidity now at its highest point ever, Bitcoin could be poised for another significant price surge. If this trend continues, Bitcoin’s fixed supply and growing demand could lead to another major bull run.

Investors are keeping a close eye on this liquidity expansion, with many expecting that Bitcoin’s next move may reflect the historical relationship between rising liquidity and cryptocurrency price increases.